Its been over a week since I posted so I thought I’d write about something that is a little bit different and hopefully may provide a little bit of food for thought. The above chart shows the performance of the MSCI Australia Value index (dominated by low PE stocks) vs MSCI Australia Growth index (dominated …

Monthly Archive: June 2012

Jun 19

Australian Government Bond Yields…a little lower still this month

Source: Reserve Bank, Bloomberg I’ve placed this chart on my website more as a reference for an upcoming presentation I’m giving than for any real message it conveys. Basically not too much change…yields are slightly lower than they were at the end of May but they increased a little from a couple of weeks ago …

Jun 18

So much for the Greek election…Spanish bond yields getting ugly

Source: Bloomberg Spanish bond yields are a far greater concern than Greece…Greece’s exit from the Euro unfortunately is inevitable and the Pro-Austerity victory in the election will just create a delay for, hopefully, an orderly exit from the Euro. With Spanish 10 year bond yields now above 7%, which are completely unsustainable levels, another bailout will undoubtedly …

Jun 12

So much for the Spanish bailout…yields are heading higher

[table id=1 /] So much for the Spanish bailout… Their 10 year bond yields are heading back up towards 7% and Italian 10year bonds are over 6% and trending up. The half life of any temporary bailout appears to be getting shorter and shorter…not that European equity markets care too much…they’re up a little bit …

Jun 10

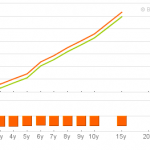

Infrastructure in an investment portfolio…diversification benefits?

Recent years has seen increased interest in infrastructure being included in investment portfolios. The justification goes that, infrastructure assets provide steady income streams linked to inflation from large, often monopoly assets (like toll roads, airports and the like), with long lifetimes that can reduce the capital volatility. As the following ten year chart shows, global infrastructure (represented …

Jun 07

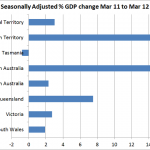

Great GDP result…though we’re still a multi-speed economy

I know I’m a day late with this but anyway… like everyone I was absolutely shocked at the sensational GDP result that came out yesterday. Since August last year the bond market has been moving in a direction that indicates our economy is not what it seems but nevertheless the 12 months to March 2012 shows real …

Jun 05

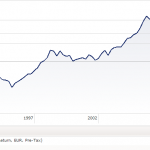

Spanish Property…and we complain about A-REITs!

Source: Morningstar The above is a long term chart of the S&P Spain Property Total Return index denominated in Euro. I was doing some other work looking for a particular index and came across this one…I thought it might be interesting and I guess it is…if you’re not Spanish. I don’t know how many property securities are …

Jun 01

Negative Interest Rates Anyone?

Australian Government Bond Yield Curve – 1 June 2012 – 4.06pm Source: www.bloomberg.com The 3 year Australian government bond is currently 2.06%…this is truly extraordinary. When you throw in the fact that Germany, USA, and Switzerland also have record low bond yields its really looking like a serious run for safety…but major equity markets haven’t really moved …