Can’t believe I missed this…one of the finest finance thinkers around, Satyajit Das, has a blog entry on Economonitor discussing the current risks of the Australian economy…please click here for Part 1 and here for Part 2. So these are the must read, not Fureyous… 🙂 In these articles Das eloquently articulates the major influences on …

Category Archive: Economy

Jan 29

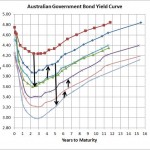

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 11

Australian Goverment Bond Yield Curve…noisy improvement

Source: RBA The above chart shows the latest Australian Government Bond Yield curve which is around 5 to 2obps higher than it was a little over three weeks ago. On the scale of yield curve movement over the last few months its largely market noise and is therefore relatively meaningless…the market is still pricing in further …

Jan 10

The change in outlook for the 2011 Australian Economy in one picture

Source: RBA The above chart shows pretty much what happened to the outlook for the Austrlaian economy and why bonds were the best investment for the year. It shows the longer terms yields (3 years and above) dropping by up to 200bps thus providing very large capital gains for bond investors who had the courage …

Dec 19

A few too many ‘China Hard Landing’ stories for my comfort

I’ve read a few too many times how Australia is well positioned because of its exporting links to China and how this should help us escape any serious economic issues flowing out of Europe. Obviously our markets haven’t quite agreed with that with bond yields dropping massively over recent months and our equity market continuing …

Nov 30

Australian Government Budget Surplus…a very poor decision

Normally I don’t like to comment on actions by the Australian Government but with the announcement of a cut in expenses in order to obtain a budget surplus I have to. Its widely recognised that the level of Australian Government debt is very low by world standards. If you look at my last post on …

Nov 24

Australian Government Bond Yields…seriously low

Source: RBA Just when you think the yield curve can’t get any lower, the last 8 days have taken another 10 to 15bps off. Sharemarkets have obviously dropped on the Euro-debacle and this yield curve demonstrates not only significant interest rate reductions in the months to come but a significantly slowing Australian eonomy thanks to …

Nov 16

Australian Government Bonds…even lower!

Source: RBA Since August the Australian Government Bond yield curve has dropped massively indicating the lower expectation of interest rates and the deteriorating outlook for our economy. I’ve voiced my increasingly bearish view of the Eurozone situation so I won’t go on any further about so I’ll mention the new addition to my yield curve…the …

Nov 03

Australian Government Bond Yields…more rate cuts to come?

Source: RBA In just 3 business days the yield curve has dropped down to where it was at the end of September where markets had experienced eight weeks of gloom and doom. Mind you, a lot happened in the three days to the end of yesterday…including the Greek’s putting significant doubt in the Euro rescue …

Oct 29

Australian Government Bond Yields…small improvement

The last month has shown a bit of a bounce-back in the sharemarkets but as the above yield curve indicates, so far its more of a dead cat bounce and there’s a long way to go. The yield curve is still negatively sloping to beyond two years indicating the market is expecting a few rate …