One of my favourite reports has just been released, Credit Suisse Global Returns Yearbook. Aside from showing long term investment returns from the major exchanges around the world there are some fascinating articles on some of the latest thinking that relates to investment considerations. This year the articles are… The low return world Mean reversion, …

Category Archive: Fixed Interest

Feb 11

A quick look at equity and bond markets

Source: www.incrediblecharts.com As the above chart shows the Australian Sharemarket has had a stellar run over the last 3 months. Not a hint of volatility just upwards she goes from around 4350 to just short of 5000…throw in a very small number of dividends and its a superb return. Newspaper talk has suggested that there is a …

Jan 11

Australian Government Bond Yield Curve…still barely moving but…

Source: RBA, Delta Research & Advisory I had no idea that I’ve only posted twice since November, so here I am again with my favourite chart, the Australian Government Bond Yield. As the above chart shows, over the past couple of months, yields have increased on average around 20bps across the longer end of the …

Dec 18

Australian Government Bond Yield Curve…maintains its trading range

Source:RBA, Delta Research & Advisory As the title of this post suggests, no real significant movement over the past month or since the RBA dropped its cash rate down by 25bps. The yield curve has improved marginally but overall its still within its trading range that was more or less set between May and June …

Dec 08

Some Bond Return Distribution Stats

Source: Mornngstar Direct, Delta Research & Advisory The above chart shows distributions of excess monthly returns over the UBS Bank Bill index from July 2000 to November 2012 for four different indexes that more or less represent the different strategies a bond portfolio can accept… Citi AusBiig 1-3 Yr index … representing short duration Citi …

Nov 15

Australian Government Bond Yield Curve…certainly not going up

Source: RBA I’ve uploaded the above chart in preparation for a presentation I’m giving tomorrow on portfolio construction. Anyway, the message isn’t really a great deal different from previous posts commenting on the Government bond yield curve. Namely, Interest rates are very low…you should be able to get some nice low fixed interest rates for …

Nov 09

Beating the Inefficient Fixed Interest Benchmark

Its widely agreed that size-weighted fixed interest benchmarks are a poor construct when it comes to creating the optimal fixed interest portfolio. The logic from most people goes along the lines of “why would I accept the index as optimal and overweight my portfolio with the biggest issuers because they are the riskiest and more likely to default …

Oct 05

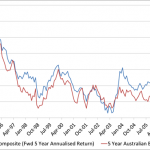

Outlook for Bond Returns…

Source: Delta Research & Advisory, RBA, Morningstar Direct The above chart shows the forward 5 year annualised return of the UBS Composite Index and the 5 year Australian Government Bond index. The last data point in the chart is Septembr 2007 meaning the forward 5 year return is the annualised return of the UBS Composite …

Sep 18

Australian Government Bond Yield Curve…no change???

Source: RBA, Delta Research & Advisory Bizaarely as it seems but the above chart shows that over the last month the Australian Government Bond Yield curve has barely budged. There’s really no more than 5 to 10 bps difference across all terms and when you consider the various big announcements, economic results from here, overseas …

Aug 20

Australian Government Bond Yield Curve…continued improvement

Source: RBA With equity markets improving over the past few weeks, so too have Australian Government Bond yields increased. 10 Year yields were below 3% a couple of months ago and now they are hovering near 3.5%. For Australian bond fund owners that should be a capital loss of close to 2% since mid-June. Nevetheless …