Everything I do in my day job is in one way or another a function of the investment committee. My roles vary from governance oversight as Chair, keeping consultants and portfolio managers on their toes as an investment specialist independent member, or perhaps I am the consultant who provides advice on portfolio design including asset …

Category Archive: General Investment

Jun 28

A Few ESG Investment Thoughts

ES Investing Possibly the biggest trend in investing today is the shift towards ES investing. No, that’s not a typo because it is the E (Environmental) and S (Social) factors of ESG investing that are experiencing the greatest focus as humankind faces existential threat from climate change (i.e. E) and numerous social issues, whether racism, …

Apr 24

Worry about Valuations??? … yeah, a bit …

The biggest market in the world, often represented by the S&P 500 index, crashed pretty quickly from 24 February reaching its bottom on 23 March. This fall, in US Dollars, was around 34%. Since then, it has bounced back by around 25% after almost 5 weeks … not a bad turnaround, but obviously not back …

Mar 19

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

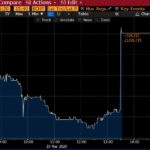

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

May 31

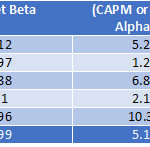

A Few Investment Selection Faux Pas

Over the years having worked in consulting and research I have been sent countless portfolios for opinion. Virtually all portfolios have followed a pre-defined asset allocation aligned to a specific risk profile but occasionally that is where the alignment ends. This is because the investments selected bear little to no relationship with their desired characteristics …

Apr 27

From Asset Allocation to Risk Allocation

Background After capital market forecasts and assessing investor objectives, the current method for portfolio construction starts with the asset allocation decision followed by investment selection. In the Australian financial planning industry, it widely accepted that the asset allocation decision is responsible for most of the portfolio performance variability, and it is, rightly or wrongly, regarded …

Mar 14

Diversification … clearing up what it is and what it isn’t

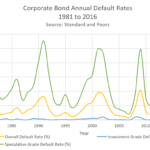

Diversification is one of the central tenets of investment management and fundamental beliefs across the global financial planning industry. Its validity was set in stone by Harry Markowitz in his PhD dissertation and 1952 Journal of Finance article, Portfolio Selection, which demonstrated the effects of combining uncorrelated assets … i.e. improvement in the portfolio’s return …

Jan 14

Designing the rules of the game … Investment Policy Statement (IPS)

The following article was published by Professional planner Magazine a couple of months ago and whilst can be found on their website by clicking here … the original article follows. Background One of the biggest trends in the financial planning today is the shift towards managed accounts. This is primarily an exercise in increasing efficiencies …

Aug 29

Beware the Benchmark Hugger … it might be you?

Background For quite a few years now, many commentators and researchers have criticized active strategies that charge active fees to receive benchmark-like returns. If a portfolio looks a lot like the benchmark it is trying to outperform, it doesn’t mean there won’t be outperformance, but after taking fees into consideration it is much more difficult. …