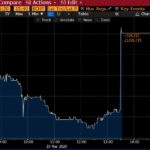

The above interactive chart shows what the latest crisis events have invoked on the Aussie dollar. At the time of writing trading around $0.57US which is down from a high in July 2011 around $1.10US … so almost half. Unfortunately for our currency this is what happens when crises occur … investors run to the …

Category Archive: Uncategorized

Mar 19

RBA announces 3yr target of 0.25% and drops cash to 0.25% … & a very strange yield curve

Reaction to 3 year bond price in the first chart below … that’s still a 0.5% yield to maturity. So the RBA are saying they want 0.25% yield to maturity which is a high bond price but only little bit of interest in the first 5 minutes or so off the bat. Source: Bloomberg A …

Mar 19

Most markets are mostly efficient most of the time … maybe not so much now

Its clearly been a long time since I updated this blog and perhaps this current crisis makes most sense to make a comeback; particularly given I started this blog not long after the worst of the GFC (Jan 2009 to be precise). Anyway, the current crisis has clearly required a global response to slow down …

Aug 07

Four Stages of Investment Analysis

Professional Planner magazine published the following in their June Magazine and also on their website … you can also click here. Otherwise … read on … On the first Friday in May, the Chief Investment Officer of the Future Fund, Raphael Arndt, spoke about how they are refining their approach to their listed equities investment …

Feb 11

A quick look at equity and bond markets

Source: www.incrediblecharts.com As the above chart shows the Australian Sharemarket has had a stellar run over the last 3 months. Not a hint of volatility just upwards she goes from around 4350 to just short of 5000…throw in a very small number of dividends and its a superb return. Newspaper talk has suggested that there is a …

Nov 06

Melbourne Cup …. Quant View

No its not my quant view but the famous Macquarie Research quant research paper on the Melbourne Cup can be found here… MFS Equitiess Research – Melbourne Cup Research! Send article as PDF

Jul 27

Quick update

I’m in New York on an investment researcher’s conference and will be back in the coming days and hopefully will restart posting again! Had a good session a few days ago with a great presentation on how low volatility stocks have produced outstanding long run investment returns over many years…should be an index product on …

May 10

A Few Investment-Related Budget Outcomes

As expected the Federal Budget focused on a surplus and to the government’s credit is looking to distribute some of their mining profits to the not so wealthy. Whilst the opposition is suggesting that some of the cash payments will be going straight to retailers instead of their intended purpose, that’s not necessarily a bad …

Mar 15

Having a crack at Goldman Sachs

Yesterday, the New York Times published details of a resignation letter of a very senior Goldman Sachs employee who totally ripped into the culture and product flogging mentality of Goldman Sachs. For anyone interested in the letter, whcih is quite an entertaining read for those of us in the industry, here it is… Goldman Sachs Letter. …

Feb 18

RSS Feed not currently working

Since I changed the look and feel of Fureyous, it appears the RSS Feed has ceased to work so my apologies for those of you who receive notification of posts via RSS. I am currently working on fixing it and will advise by updating thispost once it is working again. I made an attempt a …