It has certainly been a while since I posted and, no, this blog is still active and hopefully I’ll be able to produce some good stuff sooner than later. Lots of analysis done, some interesting stuff too, just need the time to write it up. Anyway, I digress… I’ve just finished a short little Research …

Tag Archive: Economy

Jun 12

RimSec June Research Report

The RimSec Monthly Research report came out today and can be downloaded here. Whilst the view hasn’t changed too much…i.e. inflation is low, interest rates across the curve to stay low, thanks to the weakening Australian economy…there’s also a little piece on Japan and their massive fiscal and monetary expansion…if it works it could be …

May 14

Rimsec May Research Report

The Rimsec Monthly Research report came out today which has commentary on current investment market themes, interest rate thoughts and some information on one of the significant risks within China…their property bubble. Anyway, if it is of interest you can download it by clicking here. Send article as PDF

Jan 11

Australian Government Bond Yield Curve…still barely moving but…

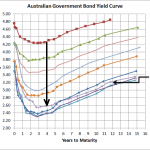

Source: RBA, Delta Research & Advisory I had no idea that I’ve only posted twice since November, so here I am again with my favourite chart, the Australian Government Bond Yield. As the above chart shows, over the past couple of months, yields have increased on average around 20bps across the longer end of the …

Dec 18

Australian Government Bond Yield Curve…maintains its trading range

Source:RBA, Delta Research & Advisory As the title of this post suggests, no real significant movement over the past month or since the RBA dropped its cash rate down by 25bps. The yield curve has improved marginally but overall its still within its trading range that was more or less set between May and June …

Oct 22

Australian Government Bond Yield Curve…still struggling

Source: RBA & Delta Research & Advisory I can’t believe how time is flying and it is more than a month since I posted my last bond yield curve. The Mid Year Economic & Fiscal Outlook released today has provided numbers supporting a further slowdown in government revenue and this economic weakness has certainly been …

Oct 10

Impact of the rate cut on house prices

I am a little amazed at how many articles across the newspapers of Australia have suggested that residential house prices are going to go through the roof given the latest interest rate reduction from the RBA. The chart below shows that house prices have declined over the last couple of years or so, but somehow its …

Sep 18

Australian Government Bond Yield Curve…no change???

Source: RBA, Delta Research & Advisory Bizaarely as it seems but the above chart shows that over the last month the Australian Government Bond Yield curve has barely budged. There’s really no more than 5 to 10 bps difference across all terms and when you consider the various big announcements, economic results from here, overseas …

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Aug 02

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …