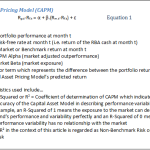

Background There’s a widely held belief that to create alpha (i.e. positive returns after adjusting for risk…let’s say market risk), a manager needs to make meaningful bets away from the market. That is, stop being a “benchmark hugger”, concentrate the portfolio with best ideas, and/or move the portfolio holdings away from the benchmark and possibly …

Tag Archive: General Investment

Nov 07

The importance of asset allocation in Australia…BHB revisited

We’ve all seen various developments in product design from hedge funds to long/short to real return approaches, and then there’s the increased focus on tactical and dynamic asset allocation. You would expect all of this to lead to different drivers of portfolio risk…i.e. away from traditional asset class drivers to market timing, investment selection, and …

Sep 20

A widely accepted portfolio construction flaw

The typical approach to portfolio construction in the world of financial planning is a 2-step process (of course, this is after the desired risk and return characteristics are settled). The first step is setting asset allocation and the second is investment selection where most of the industry chooses to select from a variety of managed fund strategies. …

Feb 21

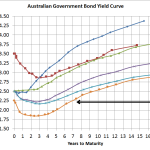

A few simple thoughts on a few not so simple markets

Following are my recent thoughts around markets with many charts to support these views. These views are far from complete but do represent a reasonable summary at this point in time. Income Assets Source: RBA, Delta Research & Advisory The above left chart suggests the market believes the cash rate is heading towards 1.5% …

Aug 07

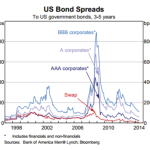

The disappearing credit spread…US now at pre-GFC levels

Source: RBA I know this probably an overly simplistic way of looking at investment grade credit markets…but…the above chart is currently showing that US investment Grade credit spreads have declined to be in the ballpark of pre-GFC levels. Personally, the US economy is still relatively weak, albeit getting stronger, but I no longer believe this …

Aug 01

Ramblings about Unconstrained Debt Funds and Portfolio Construction…wonkish and a work in progress

I’ve just returned from a manager research trip in the UK where we visited a variety of strategies from a variety of managers and fortunately for me, with some of the leading thinkers and researchers in the advice industry (hat tip D&G … and I don’t mean Dolce and Gabbana). Several of the managers we …

May 09

How often should we rebalance portfolios?

It appears that the financial planning industry is a big believer in rebalancing but a little unsure as to how often. Some accept the automatic quarterly option, some rebalance at the client review, some annual, or even at 13 months to potentially reduce capital gains tax by taking advantage of the 50% CGT discount. Because the …

Apr 24

Absolute return investing…a nice goal but disappointment is likely

Absolute return investing, according to many definitions, is about getting positive returns irrespective of the overlying “market” return of whatever asset class the investor is being exposed to. This essentially means that any “absolute” returning investment needs to employ strategies that are independent of market direction. For example, if the market (and it can be …

Jan 14

Cliff’s Top 10 Peeves…and a couple of my own

I know this is possibly a little old now but one of my recent favourite articles is about to be published in the Financial Analysts Journal, My Top 10 Peeves, by Cliff Asness of AQR. Just click the article name to open and read for yourself. There are quite a few gems in there but …

Sep 23

RimSec September Research Report

This was written last week so is only a couple of days old so here is the RimSec monthly research report for those who are interested. Click here to download. There is the usual commentary on interest rates, the economy, and market expectations. The final article is a small piece on what is happening and …