Background According to (Elroy Dimson, 2010) the “conventional view Is that, over the long run, corporate earnings will constitute a roughly constant share of national income, and so dividends out to grow at a similar rate to the overall economy. This suggests that fast-growing economies will experience higher growth in real dividends, and hence higher …

Tag Archive: Macroeconomics

Feb 07

Some Simplisitic Australian Market Analysis … setting a forecast baseline and a few trend-lines

Like all economies, the Australian economy is always facing significant challenges. Since 1970 there has been the 1973 oil crisis and double digit inflation of the 1970s, the 1980-81 recession, further high inflation of the 1980s, crash of 1987, the recession we had to have in 1991, Asian crisis of 1998, global tech crash from …

Nov 25

How the economic machine works…by Ray Dalio

Source: www.economicprinciples.org The above video (hopefully its working) is easily the best description I’ve seen on how economies operate and an absolutely must see for anyone interested. In the context of the Australian economy it certainly does sound a few bells…perhaps alarm bells…particularly when you consider that the Australian economy has not experienced particularly good …

Aug 15

RimSec August Research Update

I can’t believe its four weeks since my last post so obviously its been a terribly busy period. Anyway, something I have completed is a market/economic update and if anyone’s interested you can download it here. The update is probably consistent with what is being said everywhere…but either way… The mining investment boom is over …

Jul 12

RIMSec July Research Report

It has certainly been a while since I posted and, no, this blog is still active and hopefully I’ll be able to produce some good stuff sooner than later. Lots of analysis done, some interesting stuff too, just need the time to write it up. Anyway, I digress… I’ve just finished a short little Research …

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

May 30

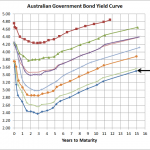

Australian Government Bond Yields…setting new records

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

Apr 30

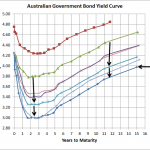

Australian Government Bond Yield Curve…new lows

Source: RBA I know its just a week and a half since I last provided an Australian Government Bond Yield curve update but over this time the curve has dropped another 20-25bps to mostly be below the bottom from 19th December. This is largely on the back of weak inflation data…deflation if you look at the seasonally …

Apr 08

Bad economic data is underway

Source: www.zerohedge.com Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there …

Apr 02

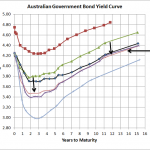

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …