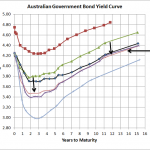

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

Tag Archive: Yield Curve

Apr 30

Australian Government Bond Yield Curve…new lows

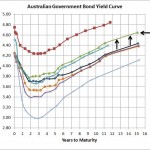

Source: RBA I know its just a week and a half since I last provided an Australian Government Bond Yield curve update but over this time the curve has dropped another 20-25bps to mostly be below the bottom from 19th December. This is largely on the back of weak inflation data…deflation if you look at the seasonally …

Apr 24

No wonder Term Deposits are popular…annuities too

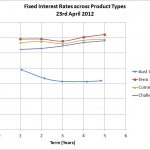

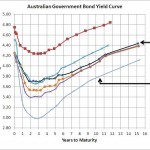

Source: RBA, Comminsure, Challenger Life, RimSec The above chart is pretty strong evidence as to why investors are placing their money into term deposits and annuities…very very attractive margins over government bonds. As you can see, at the 5 year term the interest rates for term deposits and annuities are almost double! When you consider that …

Apr 19

Australian Government Bond Yields…heading south again

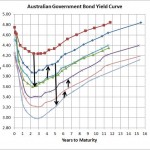

Source: RBA The above chart shows that bond yields shows that after bond yields reached a high around 1 month ago they have declined across all terms by around 50bps. That means that most of the traditional bond funds would have produced capital gains of around 2% over that last month (because the duration od …

Apr 02

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …

Mar 20

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Mar 06

Australian Bond Yields…still edging up

Source: RBA I know the above chart is a couple of days old but there’s not much change since last Thursday. At its simplest what it shows is that the bond market is still expecting the Reserve Bank to decrease interest rates some time during the year…with 1 year bond yields at less than 4%, …

Feb 09

Australian Government Bond Yields…still creeping up

When I saw the headline in the Market section of today’s Australian Financial Review I thought bond yields must have gone through the roof but the above chart shows that there ‘s only a relatively small increase compared to a couple of weeks ago. Markets had obviously priced in a rate decrease from the Reserve …

Jan 29

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Dec 19

Australian Government Bond Yields…there’s now a 2 there

Source: Bloomberg & RBA Thought I’d check the Australian Government Bond yield curve to see if the market is confirming my bearish sentiment on the Australian economy and it looks like it is. 3 Year bond yields have dropped below 3%…that’s an ugly indicator for our economy. Send article as PDF