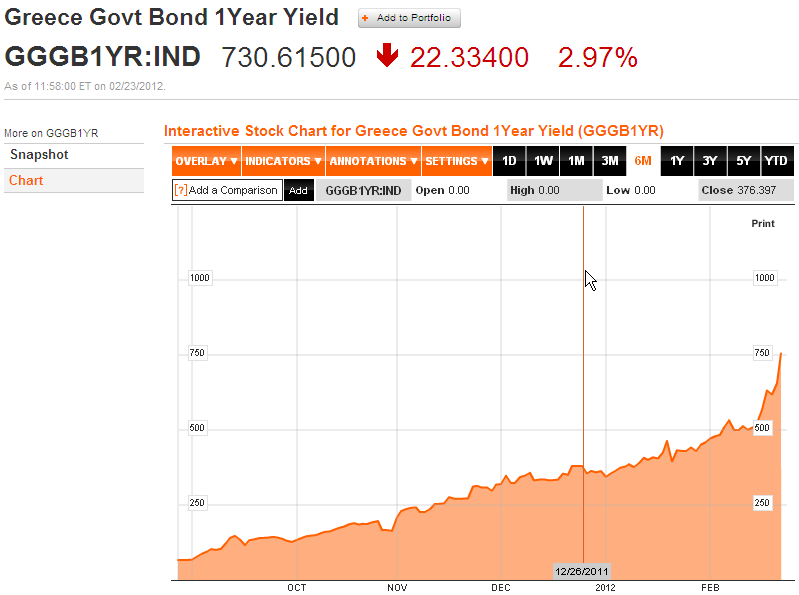

Unfortunately whilst the yield on Greek 1 year bonds is high at 730% (yes there’s no decimal point), it can hardly be described as good. When you have a 730% interest rate on your 1 year loan, its pretty safe to say that your chances of paying it back are zero. I understand why Greece is being bailed out (essentially to avoid a Lehman’s type contagion on banks and markets) but default is inevitable.

The fiscal austerity that is being imposed on Greece will reduce government expenses but will do absolutely nothing to increase government revenue…this is a requirement for Greece to recover. So the Greek situation will just get worse as revenues continue to fall due to continued vicious cycle of higher unemployment and lower consumer expenditure and for government that means lower tax revenues and higher debt requirements and therefore continued higher interest rates.

I originally put this chart up because I found it somewhat of a joke, but its not a joke at all, its actually a nightmare for many innocent people.