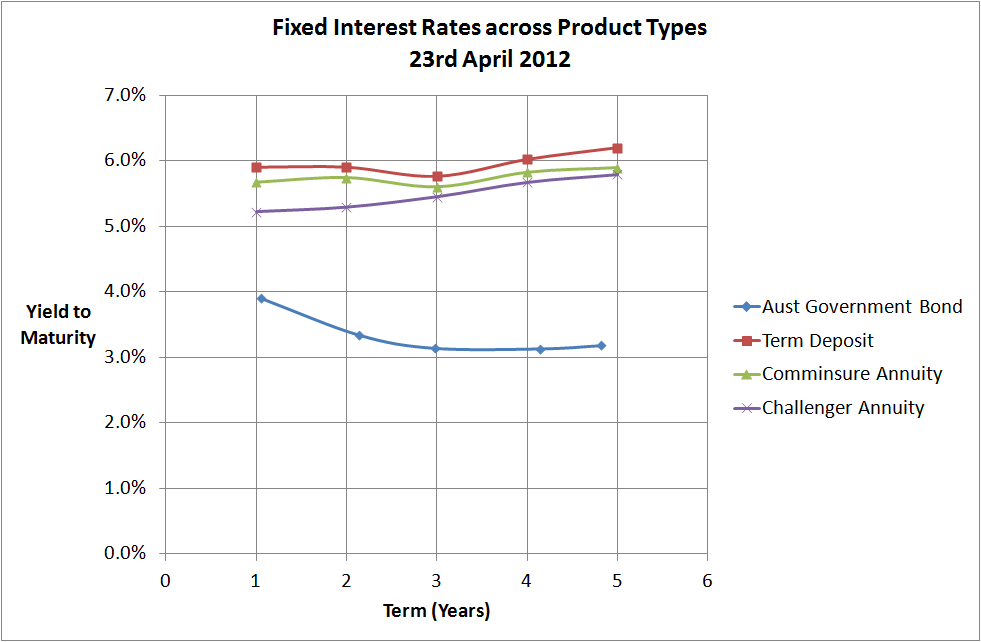

Source: RBA, Comminsure, Challenger Life, RimSec

The above chart is pretty strong evidence as to why investors are placing their money into term deposits and annuities…very very attractive margins over government bonds. As you can see, at the 5 year term the interest rates for term deposits and annuities are almost double!

When you consider that between 1962 and 2011 the Australian sharemarket only outperformed Australian bonds by 2.8%pa, and that premium is almost built into Term Deposit and Annuity rates but without anywhere near the risk of the sharemarket…in fact term deposits are government guaranteed up to a value of $250,000 and APRA monitor the life companies to ensure they have sufficient capital to meet future obligations.

To the retail investor, the sharemarket is a very tough sell at the moment and particular whilst rates are where they are. The retail investor has capitulated on the sharemarket and it looks like it’ll be quite a while, i.e. years and years, before they’ll be back.