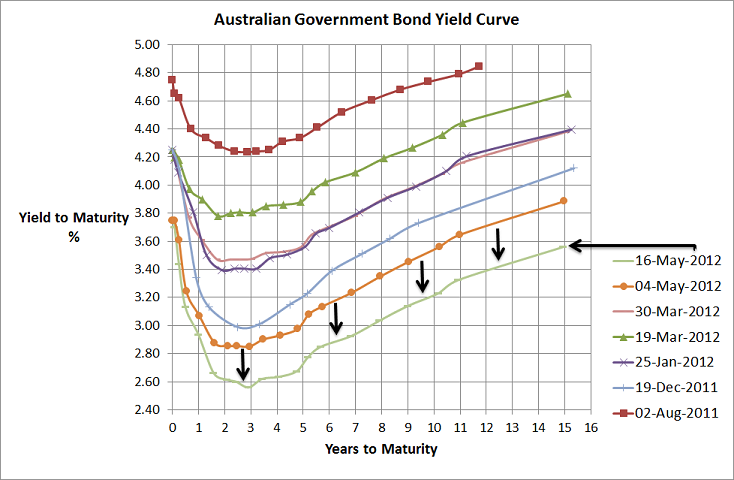

Source: RBA

In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue.

Obviously the main reason for this drop in yield is the Euro situation blowing up, yet again…and it will continue to blow up over and over for possibly years to come. The search for safe havens is much harder than it used to be and when you consider that the Australian Government Bond is one of the few AAA rated sovereign bonds available its not surprise they’re popular.

The current theme is, and I’ll quote fixed interest portfolio manager Vimal Gor of BT, “investors are looking for return of capital, not return on capital.” This is pretty difficult to argue with when you consider that German 2 Year Government bond yields are yielding 0.04%…you’d have to expect that will be a reasonably negative real return over the next 2 years but deflation is a real possibility.

Oh well, Europe is a disaster zone, its difficult to see that taking on sharemarket risk (whether here or overseas) is worth it given its downside risks are far greater than the upside potential. You can still get 5% for >1 year term deposits so tactically I’m thinking this government guaranteed (up to $250K) investment continues to be the best value around whilst the Australian banks continue to be hungry for local capital. Risk off is a well ensconced theme today and volatility should be high for many months (or years) yet.