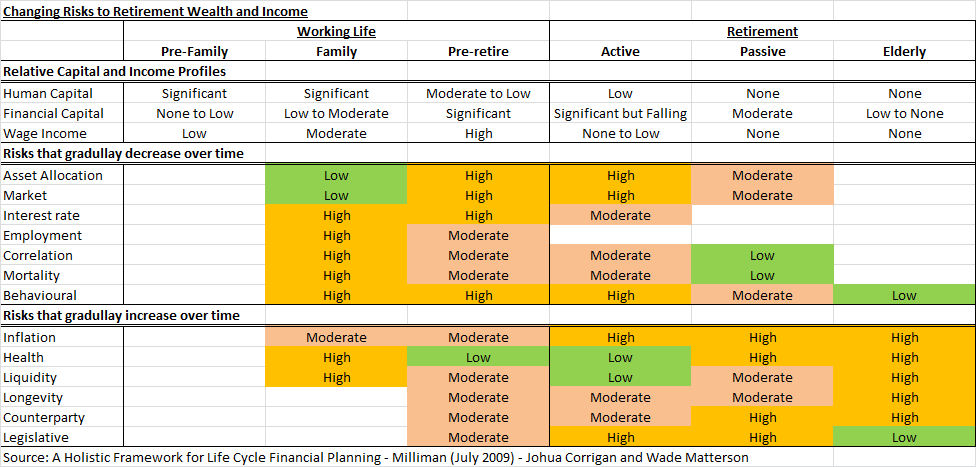

Found the above heat map in an interesting article on life cycle financial planning on Milliman’s website … click here for the article.

I think the heat map speaks for itself…(although apologies for the spelling errors..my bad)…and clearly points out the risks that generally need to be addressed at various points in time. As the map shows, inflation (and legislative) risks are highest during the retirement years…so portfolios should be designed with inflation protection in mind; (and ideally not rely on age pension or tax concessions etc…easier said then done). Mortality and Health risks are high during the family years…so mitigate that risk with an appropriate level of death, health, income protection and other life insurances. etc. etc.

For the financial planners out there,this table is not a bad tool to be used for any client situation as a discussion point to determine a client’s major concerns and then to design a strategy to address them…and to double check that all risks are addressed.