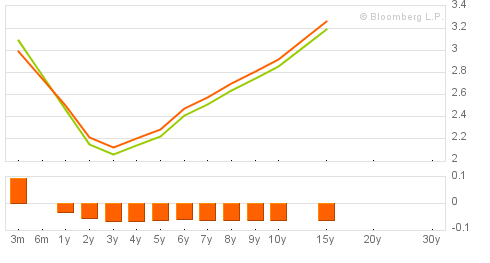

Australian Government Bond Yield Curve – 1 June 2012 – 4.06pm

Source: www.bloomberg.com

The 3 year Australian government bond is currently 2.06%…this is truly extraordinary. When you throw in the fact that Germany, USA, and Switzerland also have record low bond yields its really looking like a serious run for safety…but major equity markets haven’t really moved to the same tune…sure they’ve dropped but there’s lot further to go.

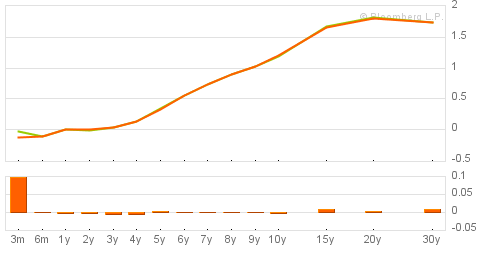

The following chart is the German bond yield curve…yep you see right…negative rates if the term is under 1 year…you pay the government to hold your money!

German Government Bonds (I’m being a bit lazy with my bond jargon)

Source: Bloomberg

To me, this is the bond markets of the world signalling the end of the Euro…the equity markets haven’t quite responded yet…or maybe bond markets are being a tad irrational…who knows. Please excuse my short termism but both asset classes look awful.

So where to put your money in this frightening looking environment…Australian term deposits still continue to be the winner…I saw a 60 day TD offering 5.3% today and you can get 5.2-5.3% for 1 to 3 year terms. At a 3 year term, that’s almost a 3.2% margin over Australian government bonds…that is truly unheard of!