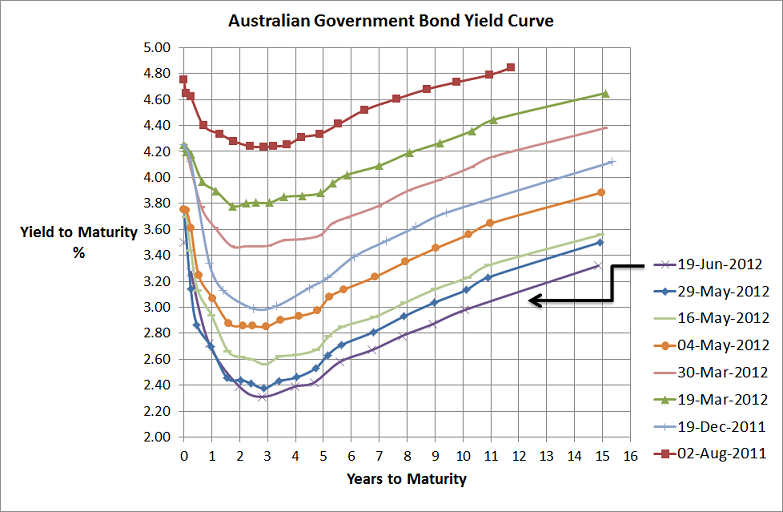

Source: Reserve Bank, Bloomberg

I’ve placed this chart on my website more as a reference for an upcoming presentation I’m giving than for any real message it conveys. Basically not too much change…yields are slightly lower than they were at the end of May but they increased a little from a couple of weeks ago and when you consider the continuation of Spanish problems with their record high bond yields (10 year bond yield was trading at a yield of 7.08% around 8.30 AEST) then low yield curve is no surprise. Anyway, sharemarket volatility and global economic uncertainty will be themes for some time yet and the bond markets are pricing in a few more RBA rate cuts too.

2 pings

Merkel Capitulates, World is Saved, Now What? | Economic Undertow

July 7, 2012 at 1:13 am (UTC 10) Link to this comment

[…] Slowdowns emerge among China vendors such as coal exporter Australia which is staring at a recession (Fureyous): […]