Source: RBA

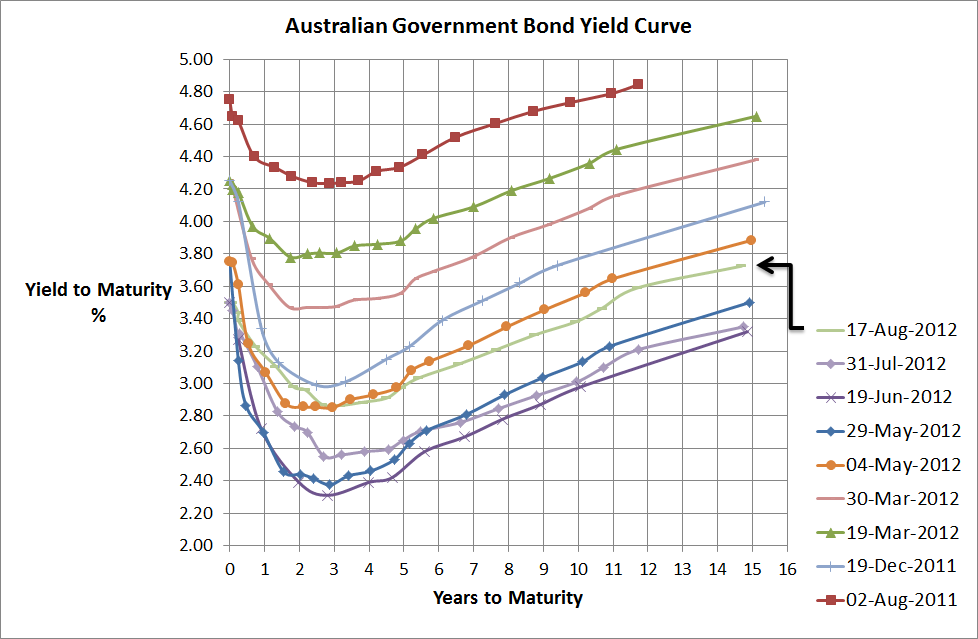

With equity markets improving over the past few weeks, so too have Australian Government Bond yields increased. 10 Year yields were below 3% a couple of months ago and now they are hovering near 3.5%. For Australian bond fund owners that should be a capital loss of close to 2% since mid-June. Nevetheless there’s a long way to go for a normal yield curve.

To be honest its feeling like the calm before the storm at the moment. Volatility indices are their lowest for a long time (Chicago VIX is around 13) and all appears fairly quiet on the European front. However, in September the Troika (ECB, EC, IMF) conducts its quarterly review on Greece’s progress and the early rimours are that the Greeks still aren’t making any headway on theiir austerity program. It’ll probably end up in more “kicking the can down the road” but a worst-case scenario would be the beginning of the end with the folding of the Greek coalition.

Anyway, I don’t really kow whats going to happen but the key message here is that’s way too early to get too over-confident with thiis strong little run in equity markets and recent sell-off in bonds. September will be a more interesting month.