Source: Morningstar Direct, Delta Research & Advisory

Source: Morningstar Direct, Delta Research & Advisory

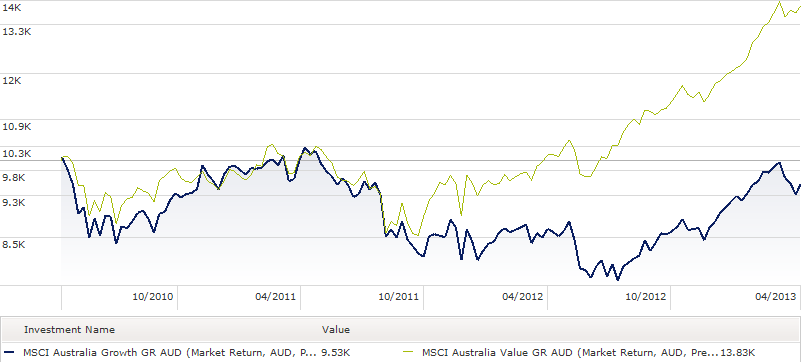

The above chart shows the performance of the MSCI Australian Value GR index vs the MSCI Australian Growth GR index and I’m sure you would agree there is quite a divergence in performance. In fact, as the numbers show over the last 3 years, the Value index has outperformed the Growth index by over 40%!!!, and this outperformance has really only occurred since late 2011. Over the last 12 months, the outperformance is around 26% which is still quite incredible. Over the last 40 years Value has outperformed Growth by around 4%pa so the numbers say a lot.

One of the defining characteristics of the Value index is the size of a company’s Dividend Yield (along with Price/Book and Forward PE Ratio) and I’m pretty confident (well actually i have no doubt) it is the “Chase for Yield” that has driven this outperformance. So whilst I understand this need for yield in the historically low interest rate environment, I can’t help but think that this price movement is a little excessive and there is likely to be some level of convergence of the two indices over the coming few years…obviously I could be wrong, but I’m thinking “short MSCI Value/Long MSCI growth” looks a reasonable likelihood.

2 pings