Source: RBA, Delta Research & Advisory

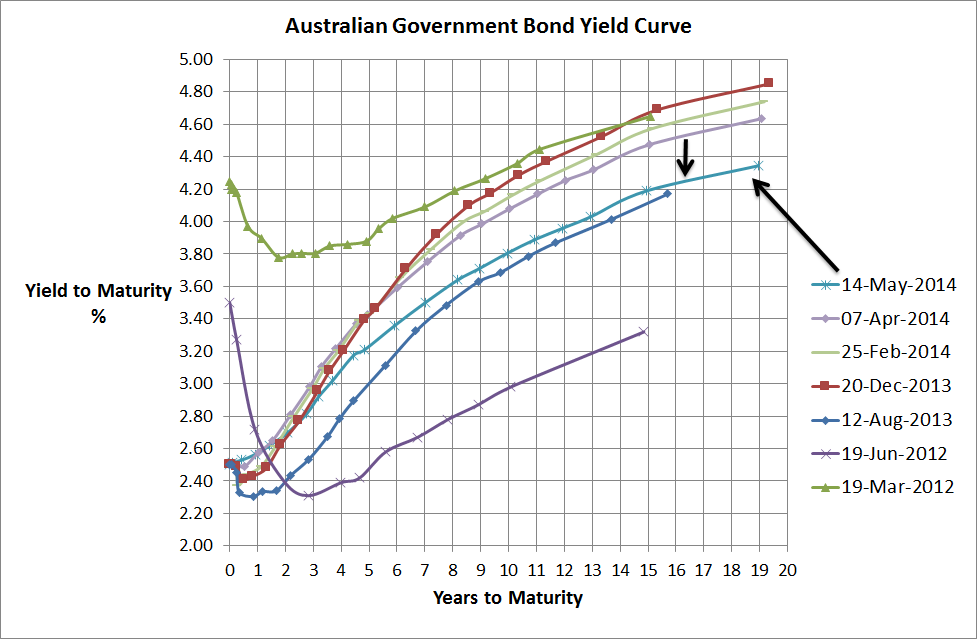

At the e shorter end of the yield curve there hasn’t been a great deal of change. This is completely expected whilst the RBA has signaled its intention to maintain its cash rate at 2.5% for some time and, whilst not easy to tell, this yield curve suggests it will be there for the remainder of 2014. Where the yield curve is most interesting is at the longer end. This year the 10 year bond yield has dropped around 45 basis points and which actually results in a reasonable capital gain if accepting some longer term duration risk, which surprisingly, many managers did. I say surprisingly because most of the “talk” has been around keeping shorter duration positions due to longer term interest rate concerns with rates consistently near record lows.

The longer part of the yield curve is more often than not a refection of the longer term outlook for the Australian economy, which is still somewhat related to inflation expectations and therefore future RBA moves. I am guessing the incredibly negative rhetoric this year leading into the, somewhat cruel, budget may have been a large factor behind the longer term yield drop. I say that because the rhetoric has been round “tightening belts”, expense reduction, or austerity and the like. When a government cuts its expenses a hit to economic growth is a reasonable expectation. Any government initiatives aimed at economic growth will have a reasonable lag before the effects flow through and of course there’s always risks that they won’t.

Moving forward the most interesting indicator to keep an eye on will probably be consumer confidence. There’s little doubt this latest government budget is a cruel budget that in one way or another impacts everyone with the greatest relative impact on the lower income earners. If consumer confidence drops, household spending drops then businesses will respond with cuts too…increased unemployment is expected by all, but if the Australian psychology becomes too negative the RBA may revert to a dovish stance again. At this stage its too early to tell and as mentioned the market is expecting rates to stay at 2.5% for a while and its always a gutsy move to argue with the market. The current yield curve is one that suggests low rates for longer and therefore low inflation too so that’s not a bad place to be for the mortgagee but like the budget, it makes for a continued tough ride for the retired.