Professional Planner magazine published the following in their June Magazine and also on their website … you can also click here.

Otherwise … read on …

On the first Friday in May, the Chief Investment Officer of the Future Fund, Raphael Arndt, spoke about how they are refining their approach to their listed equities investment program. The primary concern was whether “they are paying for (active) managers stock picking skill”. His view was “if we want factor exposures, we can access factor indices much more cheaply without paying active management fees”. The primary catalyst to this thinking is that the Future Fund faces similar issues to all investors. That is, considering the long-run outlook for investment returns being nothing more than single digits, fees are a very high proportion of the total portfolio expected return so any reduction of fee from increased efficiency will have significant impact on final returns.

As a result, the Future Fund redefined the objectives of their $38billion of listed equities into 4 categories that can be summarised as …

- Capturing equity market risk

- Harvesting long term equity factor premia

- Delivering uncorrelated, good, skill-based returns

- Accessing desired exposures with a whole of fund perspective

I’m sure you’ve judged by the title, this article is not about explaining the direction of the Future Fund. The objective of this article is to communicate the benefits of a deeper level of investment analysis than I believe is currently performed across our industry. The reason why I mention the Future Fund’s approach to their listed equities program is that they are the most recent and maybe most prominent example of the application of, what I call, the fourth stage of investment analysis. That said, there is nothing new in the application of the fourth stage but with improving technology, analytical tools, access to a greater depth of breadth of investment strategy, and the financial planning industry’s move towards managed accounts, it is probably time for advised portfolios to take the same step.

Successful application of the fourth stage of investment analysis is likely to increase the move towards designing investment portfolios that have a stronger reflection of our investment philosophy (or beliefs), a more efficient investment allocation, with increased performance risk management.

So what are the Four Stages?

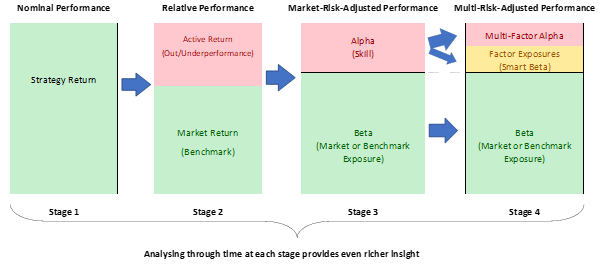

…they are best explained using a graphic as shown in Chart 1.

Stage 1 is pure performance analysis and is what most clients are solely focused on. It is focused on the overall return result and perhaps the volatility. But whilst Performance is typically a primary target, performance numbers alone (or over time) provides little insight as to whether an investment is truly good or bad. Looking only at performance often leads towards bad investment behaviours, such as selling low and buying high.

I would argue that most of the investment advisory community are at Stage 2 which is the assessment of the quality of an investment by comparing to a benchmark … which often concludes that outperformance is good and underperformance is bad. The choice of the benchmark is a critical part of this analysis and where most mistakes are made at Stage 2. Sometimes the benchmark is a peer group which may be fine depending on the investment type but best practice suggests a benchmark should be liquid representation of the underlying investment universe … so is typically a market-cap weighting of available investments. Common benchmarks include the S&P/ASX 200 for Australian equities or MSCI World for global equities.

If we believe that to achieve higher returns requires the acceptance of higher risk, then outperformance alone may be a dangerous way of assessing whether an investment is good or bad. Strategies may have benchmark outperformance over long periods of time, but not because they are necessarily skilful, but because they may be taking on lots of risk. A simple strategy example is a geared Australian Shares index fund … with the Australian sharemarket producing a performance of nearly 11%pa over the last 5 years, an initial loan to value ratio of 50% and borrowing costs at a very high and fixed 5%pa, would have produced returns for the fund in the vicinity of 15%pa. This outperformance has nothing to do with being skilful or good, it’s simply the result of accepting much greater risk than the market.

Chart 1 – Four Stages of Investment Analysis

Stage 3 adjusts for market risk and divides the portfolio’s risk into the two components we hear so much about … alpha and beta. Alpha is the market risk-adjusted outperformance often associated with measures of active management skill; and beta represents a strategy’s exposure to the market. For the above-mentioned Geared Australian Equities Index example, the Alpha should be slightly negative and close to the cost of the fund, whilst the beta (thanks to a Loan to Value ratio of 50%), should be up to 2 … which represents twice the market exposure (or risk). Whilst the geared index strategy has strong outperformance, it’s negative alpha suggests there is no skill because the return has been driven by having double the market exposure.

Understanding an investment’s Beta, or exposure to the market, is an essential part of portfolio construction because this is the measure that helps portfolio constructors determine the asset allocation role of a strategy. If we want to choose an investment that is fully representative then its beta should be around 1. If the strategy’s beta is less than 1 then that strategy may be holding significant amount of cash, so it potentially compromises the desired asset allocation and reduces the portfolio’s goal of capturing the intended “equity risk premium”. A fund with an expected beta of less than 1 will underperform its benchmark in a strong bull market, unless there is significant skill (or alpha) and, of course, that is far from a guarantee. However, that skill may also be due to luck or perhaps styles or factor exposures that happen to be in favour over a period of time. This is where Stage 4 Investment Analysis may be required.

Stage 4 investment analysis is where the Future Fund is at along with many other institutions and sophisticated investment professionals. Stage 4 further adjusts for non-market systematic risks which are typically represented by the Smart Betas that can purchased somewhat cheaply. In English, typical Smart Betas exposures may include style indexes such as Value (e.g. Low PE Ratio), Size (e.g. Small Cap), Momentum (e.g. Last Year’s best performers), Quality (E.g. High Profitability and Low Debt), and others. With the growth of the Exchange Traded Fund (ETF) market into these Smart Beta exposures, purchasing your preferred style of investing is getting easier. As Raphael Arndt of the Future alluded to, purchasing factor exposures is cheaper than pure active management and may sometimes present a more efficient way of gaining desired exposures to reflect your investment Philosophy (or beliefs) around what works in markets.

Stage 4 investment analysis explains which factor exposures (or Smart Betas) are driving portfolio outcomes as well as the exposures to each. This means that the Multi-Factor Alpha (refer Chart 1 – Stage 4) is the pure alpha (or skill) a manager brings to a strategy and is the result of their success in security selection, market timing or potentially, smart beta timing. Positive Multi-Factor Alpha is the holy grail of active management and when you consider the cheaper access of market-cap-weighted index funds, and smart beta funds, positive Multi-Factor Alpha is what investors should be paying the high fees for.

So, the Stage 4 investment analysis framework increases the chances of the portfolio constructor to choose investments that:

- Reflect one’s investment philosophy with demonstrated characteristics around desired styles that are expected to outperform (Smart Betas/Factors)

- Reflect the desired asset allocation with demonstrated market exposure that is likely to continue (Market Beta)

- Has active managers with demonstrated potential skill from positive risk-adjusted outperformance (Multi-Factor Alpha)

and,

- Demonstrates a strategy is “true to label”. That is, the strategy’s market beta and smart beta exposures are consistent with the investment process communicated by the manager

Whilst this is not the end of the portfolio construction or strategy selection process or story, implementing a Stage 4 investment analysis framework is a strong move towards a deeper understanding of portfolio risk drivers.

Understanding likely portfolio risk drivers means potentially greater efficiency as risks can then be accepted, mitigated, or even removed. It changes the manager selection or retention approach to one of return driven to risk driven. This enables strategy roles to be more specifically defined. When executed correctly, portfolios may have lower strategy turnover, therefore reduced investment costs, and therefore better returns.

Perhaps the next steps include answering the questions include … what risks do I believe add value and how do I capture them and remove the ones I don’t believe in? This potentially brings us into the world of factor investing ….