Nobel laureate economist Robert Merton says David Murray’s Financial System Inquiry must fundamentally shift how Australia thinks about superannuation. He says the desire to maximise lump-sum balances at retirement is excessively risky; the focus should be on ensuring retirement income is enough to meet a desired standing of living. Source: AFR – 6 Nov 2014 …

Category Archive: Annuities

May 31

Australian Government Bond Yield Curve…plus a bit on lifetime annuities

Source: RBA, Delta Research & Advisory Not too many posts in recent times and its been a while since I looked at the yield curve and I have to admit that after scanning the various newspapers I was expecting to see some significant moves. As the above chart shows, the curve has barely moved in …

May 20

Being a millionaire may not be enough for a comfortable retirement

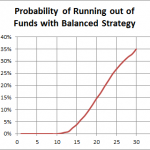

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

Apr 24

No wonder Term Deposits are popular…annuities too

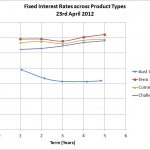

Source: RBA, Comminsure, Challenger Life, RimSec The above chart is pretty strong evidence as to why investors are placing their money into term deposits and annuities…very very attractive margins over government bonds. As you can see, at the 5 year term the interest rates for term deposits and annuities are almost double! When you consider that …

Apr 16

Retirement Income Portfolios – poorly understood

One of the debates in the financial services media has been around the investment strategy of superannuation funds and whether they are holding too many equities. In the camp of too many equities is former Head of Treasury, Ken Henry, nd former Chairman of the Future Fund, David Murray; and opposing views have typically been …

Jul 25

A Few Retirement Income Articles

I haven’t written too much on retirement income recently, well just a little bit. Anyway, before I write a whole lot more (my day job is currently focused on this area) I thought I’d post a couple of my older retirement income articles for those that may be interested…also can’t help but notice that Jeremy …

Jul 05

Lifetime Annuities…only attractive if you live to 100!

A few weeks ago I mentioned that if you survive long enough, lifetime annuities are likely to offer the best return you could possibly get, thanks to the power of mortality credits. There are only two fixed annuity providers in the industry and I decided to analyse the rates of one of them. My analysis …

May 12

The best return available for retirees

Believe it or not it comes from Lifetime Annuities…the obvious catch is that you need to survive beyond your life expectancy. In Australia, this product type has been totally out of favour since the government reduced social security benefits associated with them a few years back but perhaps this is an overreaction and their true value has …