Australian Government Bond Yield Curve – 1 June 2012 – 4.06pm Source: www.bloomberg.com The 3 year Australian government bond is currently 2.06%…this is truly extraordinary. When you throw in the fact that Germany, USA, and Switzerland also have record low bond yields its really looking like a serious run for safety…but major equity markets haven’t really moved …

Category Archive: Europe

May 30

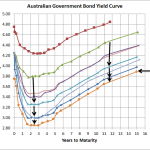

Australian Government Bond Yields…setting new records

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

May 18

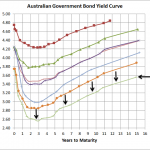

Australian Government Bond Yields…continue record lows

Source: RBA In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue. Obviously the main reason for this drop in yield …

May 12

A Slideshow on the European Crisis

Paul Krugman, Nobel Prize-winning Princeton Economics Professor, has placed an upcoming presentation on the European Crisis on his website…please click here. It is such a simple story as to how badly Europe is going, why it erred, and why to continues to err. Some of the fascinating points in his slideshow include… British GDP has performed worse …

May 07

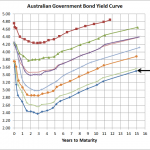

Australian Government Bond Yields…supports the dumb budget

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

Apr 19

Australian Government Bond Yields…heading south again

Source: RBA The above chart shows that bond yields shows that after bond yields reached a high around 1 month ago they have declined across all terms by around 50bps. That means that most of the traditional bond funds would have produced capital gains of around 2% over that last month (because the duration od …

Apr 08

Bad economic data is underway

Source: www.zerohedge.com Earlier in the week Zero Hedge showed the above chart and unfortunately there maybe something to it as it appears the outlook may be deteriorating. Whilst policymakers haven’t started to dither in obvious ways at the moment, with the Spanish government announcing increased austerity measures which will only make their economy worse, there …

Apr 02

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …

Mar 20

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Mar 06

Australian Bond Yields…still edging up

Source: RBA I know the above chart is a couple of days old but there’s not much change since last Thursday. At its simplest what it shows is that the bond market is still expecting the Reserve Bank to decrease interest rates some time during the year…with 1 year bond yields at less than 4%, …