Recent years has seen increased interest in infrastructure being included in investment portfolios. The justification goes that, infrastructure assets provide steady income streams linked to inflation from large, often monopoly assets (like toll roads, airports and the like), with long lifetimes that can reduce the capital volatility. As the following ten year chart shows, global infrastructure (represented …

Category Archive: General Investment

May 20

Being a millionaire may not be enough for a comfortable retirement

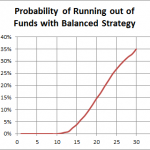

Source: Delta Research & Advisory Pty Ltd The above chart shows the probability of running out of funds in retirement for someone who retires with $1,000,000 in today’s dollar and draws $55,080 each year (ASFA Retirement Standard for a comfortable retirement for a couple), growing at 3% inflation. It is assumed the funds are invested …

May 10

A Few Investment-Related Budget Outcomes

As expected the Federal Budget focused on a surplus and to the government’s credit is looking to distribute some of their mining profits to the not so wealthy. Whilst the opposition is suggesting that some of the cash payments will be going straight to retailers instead of their intended purpose, that’s not necessarily a bad …

Mar 28

Bonds…the best protection from risky markets

Source: van Eyk The above chart shows the 12 month correlation of monthly returns between the UBS Composite index (representing Australian Fixed Interest) and the total return of the S&P/ASX All Ordinaries index (Australian shares). As you can see the correlation between both asset classes is extremely variable and the trendline shows that over the last …

Mar 27

Does our Super have too much in equities?

Over the last couple of weeks I’ve been asked to comment on the asset allocations of default super funds. There’s certainly been a very interesting debate through the print media which was probably started by David Murray, Chairman of the Future Fund, last year when he stated that Austrlaian Super Funds were too heavily invested …

Mar 20

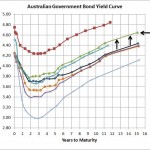

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Mar 10

SPIVA…Australian Small Cap managers demonstrate skill

The SPIVA report was released a few days ago and as I’ve mentioend before it is my favourite assessment of the success of fund managers because it takes into consideration survivorship bias…in other words, if you want to know who are the best fund managers over the last year, then you start with all fund …

Mar 06

Australian Bond Yields…still edging up

Source: RBA I know the above chart is a couple of days old but there’s not much change since last Thursday. At its simplest what it shows is that the bond market is still expecting the Reserve Bank to decrease interest rates some time during the year…with 1 year bond yields at less than 4%, …

Mar 04

Portfolio vs Asset Allocation…potential pitfalls

Many financial planners recommend their clients follow a particular Strategic Asset Allocation that may be based on the output of the combination of a risk profile as well as matching the client’s needs. For example, a popular strategic asset allocation for a “balanced” portfolio may be along the lines of… Australian Shares 35% Global Shares …

Feb 26

Jeremy Grantham’s latest Must-Read

Jeremy Grantham’s latest quarterly newsletter is on the GMO website and as usual it is an educational, pragmatic and brilliant read. There is so much to take away from this one. There are three parts to his ‘longest quarterly letter ever’… 1. Investment advice from your Uncle Polonius …which contains 10 absolute must read points. …