When I saw the headline in the Market section of today’s Australian Financial Review I thought bond yields must have gone through the roof but the above chart shows that there ‘s only a relatively small increase compared to a couple of weeks ago. Markets had obviously priced in a rate decrease from the Reserve …

Category Archive: Government Bonds

Feb 07

A little bit of Bond misinformation

I was just reading the latest riveting story on bonds in this month’s Asset magazine and I feel compelled to share an example of misinformation that tends to annoy me a little (I know its probably a little pathetic but anyway)…John O’Brien, van Eyk – Head of Research, apparently said that many of the great …

Jan 29

Australian Government Bond Yields…continue slight improvement

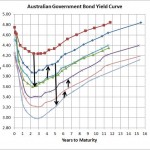

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 10

The change in outlook for the 2011 Australian Economy in one picture

Source: RBA The above chart shows pretty much what happened to the outlook for the Austrlaian economy and why bonds were the best investment for the year. It shows the longer terms yields (3 years and above) dropping by up to 200bps thus providing very large capital gains for bond investors who had the courage …

Nov 16

Australian Government Bonds…even lower!

Source: RBA Since August the Australian Government Bond yield curve has dropped massively indicating the lower expectation of interest rates and the deteriorating outlook for our economy. I’ve voiced my increasingly bearish view of the Eurozone situation so I won’t go on any further about so I’ll mention the new addition to my yield curve…the …