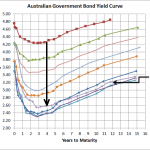

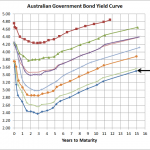

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …

Category Archive: Interest Rates

Jul 10

Australian Government Yield Curve…little change recently

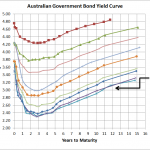

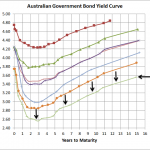

Source: RBA Its been a few weeks since I posted my last Australian bond yield curve but nothing’s really changed. I guess its even true when it comes to the economics of the world…China’s data is mixed and not as strong as once expected; US continues to produce mixed data including more weak employment data; …

Jun 19

Australian Government Bond Yields…a little lower still this month

Source: Reserve Bank, Bloomberg I’ve placed this chart on my website more as a reference for an upcoming presentation I’m giving than for any real message it conveys. Basically not too much change…yields are slightly lower than they were at the end of May but they increased a little from a couple of weeks ago …

Jun 07

Great GDP result…though we’re still a multi-speed economy

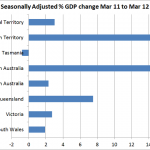

I know I’m a day late with this but anyway… like everyone I was absolutely shocked at the sensational GDP result that came out yesterday. Since August last year the bond market has been moving in a direction that indicates our economy is not what it seems but nevertheless the 12 months to March 2012 shows real …

Jun 01

Negative Interest Rates Anyone?

Australian Government Bond Yield Curve – 1 June 2012 – 4.06pm Source: www.bloomberg.com The 3 year Australian government bond is currently 2.06%…this is truly extraordinary. When you throw in the fact that Germany, USA, and Switzerland also have record low bond yields its really looking like a serious run for safety…but major equity markets haven’t really moved …

May 30

Australian Government Bond Yields…setting new records

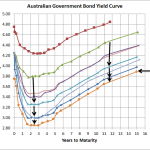

Source: RBA I know I’ve written more posts on the Australian Government Bond Yield than ever but with the yield curve hitting record lows its pretty hard to ignore. The above chart shows where the yields finished yesterday and today they’re lower again. The European situation is definitely the main driver as funds move to …

May 18

Australian Government Bond Yields…continue record lows

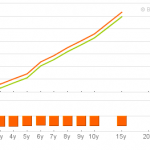

Source: RBA In less than 2 weeks the Australian Government Bond yield curve has dropped another 20bps plus and since August last year, the yield curve has dropped around 160bps on average…which means for bond fund owners double digit returns over the previous 12 months continue. Obviously the main reason for this drop in yield …

May 10

A Few Investment-Related Budget Outcomes

As expected the Federal Budget focused on a surplus and to the government’s credit is looking to distribute some of their mining profits to the not so wealthy. Whilst the opposition is suggesting that some of the cash payments will be going straight to retailers instead of their intended purpose, that’s not necessarily a bad …

May 07

Australian Government Bond Yields…supports the dumb budget

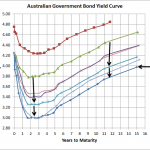

Source: RBA As the above chart shows, the yield curve has dropped 70 to 90bps for all terms since March 19. With a 3 year bond yield just above 2.80%, which is close to where it was during the worst of the GFC, its pretty obvious markets aren’t too confident in the strength of our …

Apr 30

Australian Government Bond Yield Curve…new lows

Source: RBA I know its just a week and a half since I last provided an Australian Government Bond Yield curve update but over this time the curve has dropped another 20-25bps to mostly be below the bottom from 19th December. This is largely on the back of weak inflation data…deflation if you look at the seasonally …