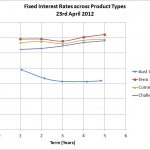

Source: RBA, Comminsure, Challenger Life, RimSec The above chart is pretty strong evidence as to why investors are placing their money into term deposits and annuities…very very attractive margins over government bonds. As you can see, at the 5 year term the interest rates for term deposits and annuities are almost double! When you consider that …

Category Archive: Interest Rates

Apr 19

Australian Government Bond Yields…heading south again

Source: RBA The above chart shows that bond yields shows that after bond yields reached a high around 1 month ago they have declined across all terms by around 50bps. That means that most of the traditional bond funds would have produced capital gains of around 2% over that last month (because the duration od …

Apr 02

Australian Government Bond Yields…a rate cut suggestion?

Source: RBA In less than two weeks the yield curve managed to drop around 15bps back to levels similar to those of late January. This is despite slightly stronger equity markets, the ASX200 made it through the 4,300 barrier for the first time in many months, and not that much in the way of really bad news…I …

Mar 20

Australian Government Bond Yields…approaching normal

Well…not normal yet. The shorter part of the curve suggests the market is expecting another two 25bps cuts by the RBA but with the Euro sovereign crisis well and truly looking much better its highly unlikely there’ll be any cuts soon. Whilst there’s plenty of evidence that shows the Euro sovereign crisis has improved, nothing …

Mar 06

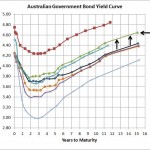

Australian Bond Yields…still edging up

Source: RBA I know the above chart is a couple of days old but there’s not much change since last Thursday. At its simplest what it shows is that the bond market is still expecting the Reserve Bank to decrease interest rates some time during the year…with 1 year bond yields at less than 4%, …

Feb 24

I always like a good interest rate or yield

Unfortunately whilst the yield on Greek 1 year bonds is high at 730% (yes there’s no decimal point), it can hardly be described as good. When you have a 730% interest rate on your 1 year loan, its pretty safe to say that your chances of paying it back are zero. I understand why Greece …

Feb 20

Excellent long term performance from bonds…but there’s a lot more to it

A look at the average returns of bonds over the last 30 years does not suggest that equity returns have really been worth the risk. Table 1 shows the returns on Australian Bonds (Aust Comm Bank All Series/All Maturities) versus the accumulated return of the Australian sharemarket (S&P/ASX 200 TR) and whilst equities have the better performance …

Feb 09

Australian Government Bond Yields…still creeping up

When I saw the headline in the Market section of today’s Australian Financial Review I thought bond yields must have gone through the roof but the above chart shows that there ‘s only a relatively small increase compared to a couple of weeks ago. Markets had obviously priced in a rate decrease from the Reserve …

Jan 29

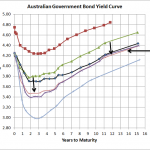

Australian Government Bond Yields…continue slight improvement

Source: RBA Its been a few weeks since I provided an update on the local government yield curve and consistent with the slight improvement in the sharemarket the Australian Government Bond Yield Curve has indicated a better outlook for the local economy. As the chart shows, since 6 January the yield curve has increased around …

Jan 11

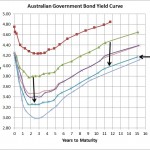

Australian Goverment Bond Yield Curve…noisy improvement

Source: RBA The above chart shows the latest Australian Government Bond Yield curve which is around 5 to 2obps higher than it was a little over three weeks ago. On the scale of yield curve movement over the last few months its largely market noise and is therefore relatively meaningless…the market is still pricing in further …