The process of financial planning is like any planning process… you find out where the client is positioned today, work with the client to establish goals whilst understanding the constraints to reaching those goals, and then design, present and implement a strategy to reach those goals…which is then reviewed on a regular basis..therefore go back …

Category Archive: Investment Strategy

Feb 11

A quick look at equity and bond markets

Source: www.incrediblecharts.com As the above chart shows the Australian Sharemarket has had a stellar run over the last 3 months. Not a hint of volatility just upwards she goes from around 4350 to just short of 5000…throw in a very small number of dividends and its a superb return. Newspaper talk has suggested that there is a …

Dec 08

Some Bond Return Distribution Stats

Source: Mornngstar Direct, Delta Research & Advisory The above chart shows distributions of excess monthly returns over the UBS Bank Bill index from July 2000 to November 2012 for four different indexes that more or less represent the different strategies a bond portfolio can accept… Citi AusBiig 1-3 Yr index … representing short duration Citi …

Nov 09

Beating the Inefficient Fixed Interest Benchmark

Its widely agreed that size-weighted fixed interest benchmarks are a poor construct when it comes to creating the optimal fixed interest portfolio. The logic from most people goes along the lines of “why would I accept the index as optimal and overweight my portfolio with the biggest issuers because they are the riskiest and more likely to default …

Nov 09

Managed Volatility…the next popular equity strategy

There’s a brief article in today’s Investor Daily News that comments on “Managed Volatility” being the strategy to maximise returns…article here. I have to admit that I believe this strategy will be one of the new trends in equity focused managed funds over the next 12 months or so. Empirical evidence over the years the …

Nov 08

Does Value offer much Value? … this is a discussion on equities performance

Source: MorningstarDirect The above chart shows the performance of the MSCI Australia Value index versus the MSCI Australia Growth index over the last 12 months (in fact through to close of trading yesterday). There’s obviously a hug divergence in performance as the Value index has returned more than 21% whilst the Growth index has barely …

Sep 18

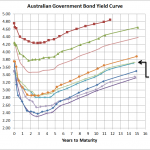

Australian Government Bond Yield Curve…no change???

Source: RBA, Delta Research & Advisory Bizaarely as it seems but the above chart shows that over the last month the Australian Government Bond Yield curve has barely budged. There’s really no more than 5 to 10 bps difference across all terms and when you consider the various big announcements, economic results from here, overseas …

Sep 13

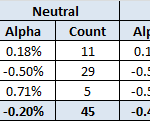

Australian Share Managers – Alpha and Risk Factors

My new company, Delta Research & Advisory, has recently conducted some risk factor analysis of Australian fund managers and it is starting to yield some interesting results. We’ve analysed around 120 managers using Fama/French-like risk factors where thhe value/growth factor is simply MSCI Australian Value index minus MSCI Australia Growth index and the Size factor is MSCI Australia …

Aug 11

Investment Perspectives

Its been a while since I put some of my broader investment thoughts in writing and I’ve just written almost 4000 words to satisfy that…so it also sort of makes up for my lack of posting. So below is a lot of what I have written and hopefully its readable for anyone interested…I actually haven’t …

Aug 02

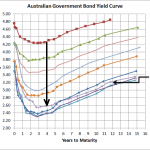

Australian Government Bond Yield Curve…slight increase but risks remain

Source:RBA The above chart shows that over the last few weeks there has been an increase of around 10-25bps across the yield curve which is also in line with the marginally stronger equity markets. As I’ve stated numerous times before, the European situation is what is currently driving most major market moves and the partial …